FUND ADMINISTRATION SOFTWARE FOR EFFICIENT BUSINESS OPERATIONS

Introduction To Fund Administration

Managing investment funds requires more than just tracking numbers and compiling reports. In today’s fast-moving business environment, efficient fund management is crucial for maintaining transparency, compliance, and investor trust. Companies in the business services industry are increasingly turning to fund administration software to simplify operations and eliminate manual errors. This digital solution is becoming the backbone of modern fund administration.

Importance Of Digital Transformation In Fund Management

Digital transformation has made its way into every sector, including financial and fund services. Traditional fund management often involved spreadsheets, manual reconciliations, and paper-based audits, making the process slow and prone to human error. The introduction of fund administration software has fund administration software revolutionized this process, offering real-time analytics, automated compliance checks, and seamless integration with financial systems.

As a result, fund managers can now spend less time on data entry and more on strategic decision-making. This shift also helps reduce operational costs and increases reporting accuracy, providing better insights for both fund managers and investors.

Core Features Of Fund Administration Software

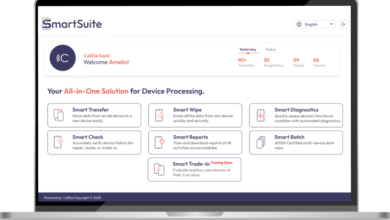

Fund administration software comes equipped with a variety of features designed to streamline workflows. Some of the most useful functionalities include:

- Automated NAV Calculation: Net Asset Value (NAV) calculations are automated to ensure accuracy and speed.

- Investor Reporting Tools: Detailed and customizable reporting dashboards allow fund managers to provide transparency to stakeholders.

- Regulatory Compliance Management: The software stays up to date with international and local regulations, automatically applying compliance rules.

- Document Management: Contracts, agreements, and investor documents are stored securely in a digital archive.

- Integration With Accounting Systems: Seamless synchronization with accounting and banking systems reduces duplication and errors.

These features collectively enhance the reliability and scalability of fund administration operations.

See also: How to Relieve Pain With Modern Physiotherapy Techniques

Benefits Of Using Fund Administration Software

Companies that adopt fund administration software enjoy a range of benefits that extend beyond operational efficiency.

- Time-Saving Automation

Tasks like reconciliations, transaction processing, and financial reporting are automated, freeing up valuable time. - Increased Accuracy

Eliminating manual input reduces the chance of errors, which is vital in fund management where precision is key. - Enhanced Security

With end-to-end encryption, access controls, and audit trails, the software ensures data is secure and compliant with data protection laws. - Real-Time Data Access

Fund managers can make better decisions with up-to-date performance data and predictive analytics. - Better Investor Communication

Integrated platforms allow fund managers to maintain transparent and professional relationships with investors by sharing reports and updates digitally.

Challenges Addressed By Fund Administration Software

Fund management firms face several operational and compliance-related challenges. Here’s how fund administration software addresses them:

- Regulatory Changes: With frequent updates in financial laws, the software ensures all transactions and processes remain compliant.

- Data Silos: It integrates different data sources into a single dashboard for better visibility.

- Scalability: As firms grow, their administrative workload increases. This software scales alongside the business without needing additional manpower.

- Audit Preparation: The centralized and well-documented database simplifies external audits, reducing the burden on internal teams.

Selecting The Right Fund Administration Software

When choosing the right software, businesses need to assess their specific requirements. Factors to consider include:

- Customization Capabilities: Does the software allow you to tailor features based on your firm’s needs?

- User Interface: Is it easy to use, or does it require extensive training?

- Cloud Vs. On-Premise: Depending on the company’s infrastructure and data sensitivity, choose between a cloud-based or on-premise solution.

- Support Services: Good customer support is essential for troubleshooting and implementation.

- Cost Structure: Transparent pricing with no hidden fees helps with budgeting and long-term planning.

Conducting a trial run or demo can also be beneficial before making a full commitment.

Future Trends In Fund Administration Technology

As with any technology, fund administration software continues to evolve. In the near future, the following trends are expected to shape its growth:

- AI And Machine Learning: These tools will further enhance forecasting, fraud detection, and smart automation.

- Blockchain Integration: Offering unmatched transparency and security, blockchain could redefine how fund records are stored and validated.

- ESG Tracking: As ESG (Environmental, Social, Governance) investing grows, the software will include modules for ESG scoring and impact measurement.

- Mobile Accessibility: Remote fund management via smartphones and tablets is becoming more common.

Firms that stay ahead of these trends will benefit from increased agility and competitiveness.

Real-World Applications

A leading example is how private equity firms are using fund administration software to handle complex fund structures. Whether it’s multi-currency accounts, investor distributions, or tax calculations, these platforms manage it all in a central system. Hedge funds, venture capital firms, and REITs are also turning to these solutions to minimize risk and maximize transparency.

In another instance, a mid-sized investment firm reduced its month-end reporting cycle by 60% after implementing a tailored fund administration software platform. This allowed them to reallocate resources and improve investor engagement.

Conclusion

In an industry that deals with high volumes of financial transactions, compliance requirements, and investor expectations, adopting the right fund administration software is no longer optional—it’s essential. This technology offers not just a means to streamline back-office tasks, but also a strategic advantage in a competitive market.

Businesses in the fund management sector must act now to ensure their administrative systems are modern, efficient, and future-proof. Whether you’re a startup fund or an established firm, investing in fund administration software can lead to better outcomes for both the company and its investors.